|

|

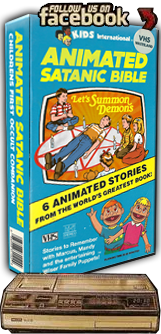

HELLO AND WELCOME TO VHS WASTELAND, YOUR HOME FOR HIGH RESOLUTION SCANS OF RARE, STRANGE, AND FORGOTTEN VHS COVERS. EACH OF THESE BIZARRE GEMS IS SCANNED AT 200 DPI. SIMPLY CLICK ON THE THUMBNAIL OF ANY VHS COVER TO DOWNLOAD THE FULL HIGH RES FORMAT. WE WILL BE ADDING A NEW COVER DAILY, SO BOOKMARK THIS SITE AND CHECK BACK OFTEN. WE'D ALSO LOVE SUBMISSIONS FROM YOU. IF YOU HAVE A VHS THAT IS WEIRD OR RARE, JUST EMAIL US AT MADHATTERDESIGN@GMAIL.COM. REMEMBER TO SCAN THE FRONT, BACK AND SIDES OF THE VHS AT 300 DPI. WE WON'T ACCEPT LOW RESOLUTION FILES. WHILE YOU'RE HERE, GRABBING OUR AWESOME FREE VHS COVERS, FEEL FREE TO CLICK THE "DONATE" BUTTON ON THE LEFT. IF ENOUGH PEOPLE SEND US SOME CASH, WE MIGHT BE TEMPTED TO KEEP BRINGING YOU THE COOLEST, HIGH RES VHS COVERS ON THE NET. BUT IF YOU GREEDY, COVER GRABBING... I MEAN... YOU WONDERFUL VISITORS TO OUR SITE, DON'T COUGH UP A DONATION, MAYBE WE'LL JUST FIND SOMETHING BETTER TO DO WITH OUR TIME. LIKE GO MAKE NACHOS. MMMMM... NACHOS. SO HELP A BROTHA OUT AND DONATE A LITTLE DOUGH TO THE CAUSE.

LASTLY, WHY NOT VISIT OUR PARENT SITE (SERIALKILLERCALENDAR.COM). IT HAS NOTHING TO DO WITH VHS COVERS BUT I THINK YOU MIGHT BE PLEASANTLY SURPRISED BY WHAT YOU FIND. OR NOT. I DON'T KNOW YOU. MAYBE YOUR NOT SURPRISED BY ANYTHING. MAYBE YOUR THE KIND OF GUY THAT SEES A COW FALL OUT OF THE SKY AND EXPLODE LIKE A PIÑATA AND YOUR ALL LIKE "HUH, THAT WAS WEIRD." MAN. WHAT'S WRONG WITH YOU ANYWAY? JEEZ. SOME PEOPLE.

BUT NO. SERIOUSLY. GO BUY SOME CRAZY AWESOME TRUE CRIME MERCHANDISE AT SERIALKILLERCALENDAR.COM. INCLUDING THE SERIAL KILLER MAGAZINE, THE SERIAL KILLER TRADING CARDS AND MUCH MUCH MORE! DO IT. DO IT NOW. CLICK THE LINK. |

History of Hollywood Entertainment Corporation

Published at fundinguniverse.com

Address:

9275 S.W. Peyton Lane

Wilsonville, Oregon 97070

U.S.A.

Telephone: (503) 570-1600

Fax: (503) 570-1680

Statistics:

Public Company

Incorporated: 1988

Employees: 20,000

Sales: $500.5 million (1997)

Stock Exchanges: NASDAQ

Ticker Symbol: HLYW

SICs: 7841 Video Tape Rental

Company Perspectives:

The company's goal is not to dominate the home entertainment industry strictly based on size, but on its commitment to consistent and innovative customer service.

Company History:

Hollywood Entertainment Corp., which operates over 1,000 stores in 43 states under the name Hollywood Video, is the second largest video rental and retailer in the United States. Second only to Blockbuster Entertainment, Hollywood has come a long way in just a decade of existence, boasting larger stores and a wider selection of video titles than its competitors.

Birth of a Video Store Chain: 1988-93

Hollywood Video stores were the brainchild of Mark Wattles, who founded his company in June 1988. Within four months, the 28-year-old Wattles opened his first store in Portland, Oregon. Wattles took his time expanding over the next few years, as the video rental and sales industry took off reaching $9.8 billion in revenues by 1990. By year-end 1991 with a handful of stores, Hollywood Entertainment Corp. generated $5.1 million, with income of $281,000. The following year, Wattles had a total of 15 operational stores in the Pacific Northwest area. Revenues for 1992 were just over $11 million, double the previous year's figures, a pattern Hollywood repeated several times in the next decade. Net income, however, was the bigger story, having gone from 1991's $281,000 to just under $1.2 million in 1992.

By early 1993, Hollywood owned and operated 16 stores in Oregon and Washington. The next big step was taking the company public; in July Hollywood initiated its first offering on the NASDAQ national market. The proceeds netted Hollywood $10.4 million, which helped with its aggressive expansion plans. By the end of the year, there were 25 Hollywood stores in three states and the company's revenues topped $17.3 million and earned net income of $2.1 million or 14 cents per share.

In the five years since Hollywood's founding, videotape rental had become much more commonplace in the United States, as nearly 90 percent of all American households owned at least one VCR, according to the Video Software Dealers Association. Some 60 million videos were rented per week during this time, as consumers came to regard renting videos as an excellent value. The burgeoning presence of video rental outlets was perhaps most influenced by the old real estate adage of "location, location, location." Studies indicated that customers preferred to go the shortest distance to high-traffic, high-visibility locations, and while there was some loyalty to store name, advertising promotions and convenience frequently determined the fate of a video outlet. Rental rates were also subject, naturally, to the whims of the weather, with harsh or inclement weather often keeping consumers at home.

However, perhaps the greatest factor affecting video rental rates was the success or failures of films by the major movie studios that supplied the video outlets. Most consumers did not realize how much major movie studios relied on video sales and rentals, which could account for as much as 45 percent of their annual revenues, higher than the amount generated by the theatrical release of most films. Americans reportedly spent twice as much on videos in a year's time than they did at the theater, which in turn gave big video chains like Blockbuster and Hollywood considerable clout with studios. Most video titles were given to rental stores for an exclusive period of time, usually 45 days, before these same films were offered for viewing via pay-for-view or cable channels such as HBO, Showtime, or Cinemax.

Hitting the Big Time: 1994-96

In February 1994 Hollywood offered a second block of shares to the public, netting $23.6 million. On the heels of the offering came the company's first acquisition: the 33-store Video Central chain headquartered in Texas. The ink was barely dry on the first purchase when Hollywood moved forward with a second in May 1994, this time buying Eastman Video, based in California. The Eastman deal contributed another 11 stores to Hollywood's growing ranks, as did a third acquisition the next month, of a ten-outlet Nevada and California chain called Video Park. Hollywood completed a third equity offer of shares in August of that year, netting proceeds of $63.6 million, which went to good use funding an expansion that included 33 new "superstores," bringing the total number of Hollywood Video stores to 113 in eight states. Year-end figures were more than encouraging for Hollywood and its high-speed expansion, as revenues leapt to $73.3 million, up from $17.3 million in 1993, and net income reached $8.1 million.

Hollywood began 1995 with an acquisition in the first quarter--this time for a 14-store Minnesota chain called Title Wave. As it had in the previous year, Hollywood brought in funds through another equity offer, its fourth and largest to date, totalling $95.4 million, which in turn made possible its next purchase. In August the company acquired the Midwest-based Video Watch, which oversaw 42 stores. At the same time, Hollywood was also constructing scores of new stores, having added 122 units by the end of the year for a total of 305 in 23 states, a 170 percent increase in size from the year before. In a sampling of eight major cities in the United States, Video Business magazine found Hollywood had captured 1.4 percent of the video rental market, to Blockbuster's 32.6 percent. Though progress seemed slow, Hollywood was determined to broaden its consumer base and finished the year with revenues of $149.4 million, double those of the previous year, and net income of $11.8 million.

In the mid-1990s the video rental and retailing industry suffered a slowdown, attributed largely to the activities of industry giant Blockbuster, which was engaged in an effort to become a one-stop shop for a wide range of entertainment products, including such noncore merchandise as music, magazines, and books. In the wake of the industry slowdown, Hollywood's shareholders too watched their stock fall from a high of $22.69 in 1996 to a low of $6.50. Unlike Blockbuster, however, Hollywood stores remained focused on video rentals, which accounted for 85 percent or more of revenues, with candy, gum, and video and other merchandise sales making up the rest. Although Hollywood management knew it routinely took three-to-five years for new outlets to hit their stride and reach optimal sales, they had not banked on an industry-wide slump.

Still, the company bounced back quickly. By the end of 1996, Hollywood was on a roll--during the year it had opened 250 new stores (including the milestone 500th store in December) for a total of 551 nationwide units in 42 states. Moreover, the company had generated $34.7 million from a fifth offering of stock. Wattles had also created a new infrastructure for the company, dividing operations along four geographic areas (East, West, South, and Midwest) and naming a senior vice-president for each region. Year-end numbers for Hollywood were very healthy, with revenues at $302.3 million, again doubling the previous year's dollars, and net income topping $20.6 million or 59 cents per share.

Taking on Blockbuster: 1997 and Beyond

In 1997 instability in the industry was again prompted by management shakeouts at competitor Blockbuster. Hollywood's stock rollercoastered again, this time climbing to over $25 per share and falling to $8.31 before stabilizing once again. Still, with the video rental and retailing industry in the $10 to $12 billion range and still growing, Hollywood continued to expand, opening a record 356 new superstores in 1997, bringing the chain to 907 units in 42 states. This year also marked the appointment of F. Mark Wolfinger, from Metromedia Restaurant Group, as chief financial officer, and later the hiring of Jeffrey B. Yapp as president, who came to Hollywood from Twentieth-Century Fox Home Entertainment. Near the end of the year, Hollywood commenced a self-tender offer to purchase a minimum of eight million shares up to a maximum of 16 million at $11 per share. The company had doubled its available bank credit to $300 million, and had broken ground on its new 123,000-square-foot headquarters. Finally, Hollywood brought in phenomenal financial results for the year, with $550.5 million in sales.

In January 1998, Hollywood was forced to set aside its self-tender offer, having failed to attain its minimum buy-back of shares. Analysts found the failure comforting; investors apparently had enough confidence in Hollywood's value not to sell for $11 a share, figuring the stock would climb. Though Wattles announced he was disappointed in the self-tender's outcome, he was nonetheless bolstered by the company's stability and said shares would be bought occasionally at the open market price.

Hollywood was still rapidly opening stores in its bid to someday dominate the video rental marketplace: its 1,000th store was opened in April 1998 in a suburb of Dallas, coincidentally the headquarters of the Viacom-owned rival Blockbuster. During this time, Hollywood was opening a new store virtually every day, and nearly 25 percent of this expansion was geared towards smaller geographic areas (with population draws in the 30,000 range) with a somewhat lower output than its larger-market stores.

Hollywood maintained its breakneck expansion speed through a real estate team of 120 who scouted locations throughout the United States and recommended new sites. Once a location was selected, it cost the company in the neighborhood of $475,000 (in 1998 dollars) to complete a 7,500-square-foot store, with nearly $200,000 dedicated to videocassettes, with 10,000 titles, and 16,000 tapes (excluding adult or x-rated titles which Hollywood did not stock) per unit, as well as about $40,000 allotted for sell-through merchandise. While most stores took in an average of $600,000 during their first year, it generally took less than three-and-a-half years to reach the break-even point. Well established stores usually brought in from $700,000 to $900,000 per unit per year, the highest rate in the industry.

By contrast, Blockbuster's average store was smaller, usually less than 6,000-square-feet, with fewer videotapes, and an average unit volume of $650,000. However, Blockbuster ruled the nation, with some 3,300 stores, more than double the number of Hollywood outlets. Competitors in video retail came in the form of such discount chains as Kmart, Wal-Mart, and Target. Other public rental chains included Movie Gallery with nearly 865 outlets; Moovies, with around 270 stores; Video Update, with just over 400 units; and West Coast Video, which had under 300 units. Industry analyst Rosemary Sisson in a NationsBanc Montgomery Securities report found that despite each of its competitors' store number or size, Hollywood still bested them with volume&mdash…eraging $735,000 per store, to Moovie's $406,000; Movie Gallery's $305,000; Video Update's $313,000; and West Coast's $406,000. Yet the real story was in same-store sales growth, where Hollywood's numbers grew consistently in each quarter while all of its competitors had minimal growth and/or declines in the same periods.

Hollywood's stores represented three percent of the marketplace to Blockbuster's 15 percent. In revenues, Blockbuster garnered a 31 percent share to Hollywood's five percent, and all the other major public chains combined held a six percent market share. Though Hollywood's numbers were not close to those of Blockbuster, the former had come from nowhere to challenge the giant and had gained a healthy slice of the video pie in under a decade. Industry pundits believed the video market was still expanding, and the competition between Hollywood and Blockbuster was not only good for both of them, but for the smaller chains and independents as well. Increased traffic, brought in by advertising dollars spent by the "big two," served the entire industry by bringing customers out of their homes to rent and buy videos.

Rapid developments in technology presented challenges to both Blockbuster and Hollywood, as videotaped movies were losing ground to pay-per-view TV, direct broadcast satellite TV, video-on-demand cable TV, DVD technology, and the latest, "disposable" DVDs or Zoom TV. However, according to Paul Sweeting in Video Business magazine, the "fundamental issue for the video rental business as a whole [was] not its vulnerability to technology but its access to capital."

As a new century approached, there was certainly no dispute that Blockbuster, with its nearly 4,000 domestic stores, was the top video renter in the United States and that Hollywood was a distant though gaining second. Most analysts predicted that further consolidation of the smaller franchises would occur and have a positive effect on the market; the chains Moovies and Video Update were slated to uphold this trend by merging in 1998. Analysts believed Hollywood would break the billion-dollar mark in revenues by 1999, and would reach, at its present breakneck pace, 2,000 stores by the year 2000. The larger question appeared to be how much this growth would affect Hollywood's share of the video rental market.

|